COVID-19 has not affected all segments of the economy equally. In what is being referred to as a K-shaped recovery, some sectors, such as technology are thriving while many small businesses, cyclical industries, the hospitality sector, and most service businesses have struggled.

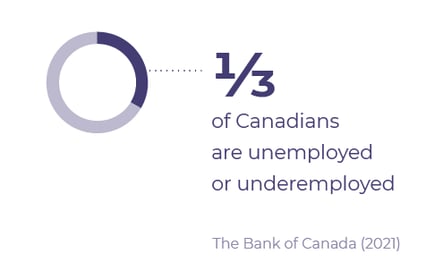

Many front-line service workers have lost their jobs or had their hours drastically cut. The Bank of Canada reported in May 2021, over one year into the pandemic, that 1/3 of Canadians are unemployed or underemployed

.

.

In what has been dubbed a K-shaped recovery and what the IMF in the 2021 World Economic Outlook has called divergent recoveries, some segments of the population are saving more and borrowing less but a sizeable segment is reliant on government COVID-19 support payments and struggling financially. The result is financial hardship and scarcity. The effects go beyond the obvious financial worries and can affect how people perceive information and make decisions.

Understanding the Scarcity Mindset

Research has described the cognitive, attitudinal, and behavioral changes that are evident in people experiencing perceived scarcity. There are observable differences between people who are coping with a scarcity of resources versus those who are not. These differences are described as a ‘scarcity mindset’.

These changes can explain some of the behaviors seen in people whose resources have been negatively affected by COVID-19. This can be a scarcity of time, calories, money, or even normal social interaction.

One effect is increased attention to immediate needs and neglecting future concerns. Immediate concerns for basic needs displace long term planning and consideration of consequences.

The constant worry over scarcity also seems to draw down our ability to think and reason. People experiencing scarcity showed worsened performance on challenging cognitive tasks and diminished control over thoughts and behavior.

Constant worry regarding resources seems to deplete our capacity for thoughtful deliberation leading to inferior choices. With multiple competing demands on scarce resources, there are constant trade-offs and decision makers view every decision as one where something must be sacrificed for something else, and they become less sensitive to future consequences.

Constantly competing for resources also seems to encourage prioritizing personal gain over prosocial behaviors and this might explain challenges with encouraging people to follow pro-social behaviors such as social distancing and mask wearing.

Finally, scarcity mindset is also associated with cognitive tunnelling where the focus is so narrowed on immediate resource needs, that resources and solutions that could help are actually overlooked.

In one BEworks project, the government was offering subsidized electricity end energy efficient home upgrades (e.g., insulation, weather stripping, LED light bulbs, etc.) to help those coping with limited financial resources, but eligible customers overlooked the opportunity for what was essentially free money received over the course of the future and did not apply.

In one BEworks project, the government was offering subsidized electricity end energy efficient home upgrades (e.g., insulation, weather stripping, LED light bulbs, etc.) to help those coping with limited financial resources, but eligible customers overlooked the opportunity for what was essentially free money received over the course of the future and did not apply.

Under scarcity, people’s preferences switch to immediate pleasure regardless of future pain. The effects are that people focus on immediate gratification, hedonism, and discretionary spending while increasing debt because they do not calculate the costs properly or because they ignore the future obligation.

In the extreme, payday loans keep food on the table, but less extreme examples can be spending on small pleasures and ignoring mounting debt. Optimism bias leads people to rationalize that they will save more next month and reduce their debt.

Unfortunately, research demonstrates it is a false hope and future savings do not materialize. Scarcity mindset induces other irrational behaviors. People may have the capacity to pay back debt, they may even cut back on discretionary spending, but instead of paying the full credit card balance off, they pay the minimum because they would rather have cash sitting in their account. Having cash available may be reassuring when resources seem scarce but paying high interest on credit card debt while earning nothing on cash in a bank account is financially costly.

For consumers, the implications are worsening financial health.

For lenders, the implications are that many assumptions regarding creditworthiness may be less true during times of perceived scarcity and lenders should re-evaluate credit granting.

Applying Behavioral Economics to Help Consumers Experiencing a Scarcity Mindset

A first line of defense that can help consumers who are experiencing a scarcity mindset is to simplify their choice architecture by reducing both the amount and complexity of information that is considered for a decision. This increases the chance that consumers will be able to find and make use of essential details, despite being in a frame of mind that exerts a bandwidth tax on decision-making.

One aspect of scarcity mindset is sensitivity to trade-offs and fear of hidden costs, including time investments that they may be called upon to make. Anticipated hassle costs can loom large enough that they stand in the way of consumers taking advantage of supports that exist to help them, such as professional financial advice or credit counselling.

One aspect of scarcity mindset is sensitivity to trade-offs and fear of hidden costs, including time investments that they may be called upon to make. Anticipated hassle costs can loom large enough that they stand in the way of consumers taking advantage of supports that exist to help them, such as professional financial advice or credit counselling.

To encourage consumers to connect with supports that are accessible to them, it is crucial to address any over-estimates consumers may have made about the time needed to get started.

It may also be helpful to identify immediate tangible benefits that consumers will achieve within a short span of time of seeking support.

In research completed by BEworks investigating why households suffering under the burden of high energy costs do not take advantage of energy cost-savings programs, we found that interventions need to consider the scarcity mindset of those they are meant to help.

We determined that consumers were not only uncertain about the time and effort required to participate in a program that can deliver energy cost-savings through free upgrades that make for a more efficient home, but they also failed to be enticed through typical incentives-based appeals highlighting how much money they could save over time.

Since their temporal focus was immediate, future benefits were of little value.

We found that consumers were more apt to be moved to action when their attention was focused on immediate, tangible benefits of the free upgrades that would help to make their day-to-day lives more comfortable (e.g., a quieter furnace, a warmer home, brighter LED lights, etc.) even while the longer-term benefits of program participation, in the form of energy savings, take time to materialize.

In another example, encouraging credit card borrowers to pay off small purchases makes improvement tangible and creates a rewarding perception of progress.

In another example, encouraging credit card borrowers to pay off small purchases makes improvement tangible and creates a rewarding perception of progress.

Given that there is often a long runway to many credit journeys, behavior change efforts need to make use of a combination of interventions – some that clarify the decision, and others that reward and reinforce small steps in a meaningful way.

This article is part of our Credit in the New Normal Series which dissects 5 credit trends brought on by the pandemic with a behavioral lens. To read the other articles in the series, click here.