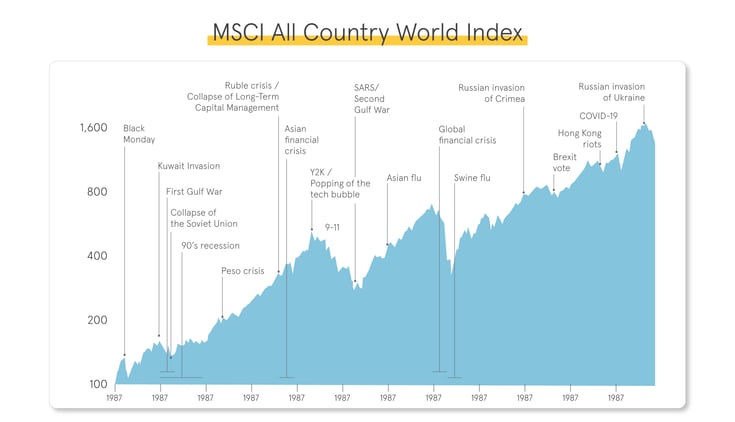

While Covid-19 remains, successive waves are no longer the focus for many. We now have a brutal ongoing war in Ukraine, oil cuts in Saudi Arabia, and rising inflation to worry about. With supply chains still recovering, commodity prices remaining volatile and talk of a looming recession, the future economic outlook may be even more uncertain than during the early days of Covid.

These macro-economic events have many underlying explanations, but these explanations provide little reassurance to many consumers deciding between filling their gas tank, paying their rent, or putting food on the table. For many, saving for the future is a distant concern. Meanwhile, others are struggling with decisions on how to protect the wealth they have managed to accumulate for aspirations like buying a home, saving for their children’s education, or retiring with some level of comfort.

As difficult as it is to comprehend at present, we are in the midst of an economic cycle. This too shall pass, like all those before.

Source: Capital Group Braving bear markets: 5 lessons from seasoned investors

But platitudes don’t help when people are dealing with complex, risky, decisions that have enduring consequences. Many of us are making sub-optimal decisions driven by emotion rather than reason. By “reason”, we mean making calculating, analytical, goal-oriented, consistent, and predictable decisions.

For example, rational investment decision-making would see investors adopt a defensive posture and follow a long-term strategy. The alternative is panic and adopting a “buy high, sell low strategy”. To understand why we often make emotionally charged financial decisions, we need to begin by understanding what is presently driving our financial decision-making.

The scarcity mindset offers one explanation for why people make sub-optimal financial decisions during times of market volatility. In turn, this offers insights on how to beat this natural, though costly, tendency.

Understanding the Scarcity Mindset

Research shows that there are cognitive, attitudinal, and behavioral changes evident in people experiencing perceived scarcity (e.g., money). There are observable differences between people who are coping with a scarcity of resources versus those who are not. These differences are described by Sendhil Mullainathan and Eldar Shafir as a “scarcity mindset”.1

These changes can explain some of the behaviors seen in people whose resources have been negatively affected by the post-pandemic world and can be seen in many different areas including time, food (basic needs), wealth, and social interactions. The constant worry over scarcity also seems to draw down our ability to think and reason. In fact, people experiencing scarcity showed worsened performance on challenging cognitive tasks and diminished control over thoughts and behavior.

Scarcity mindset has four main effects:

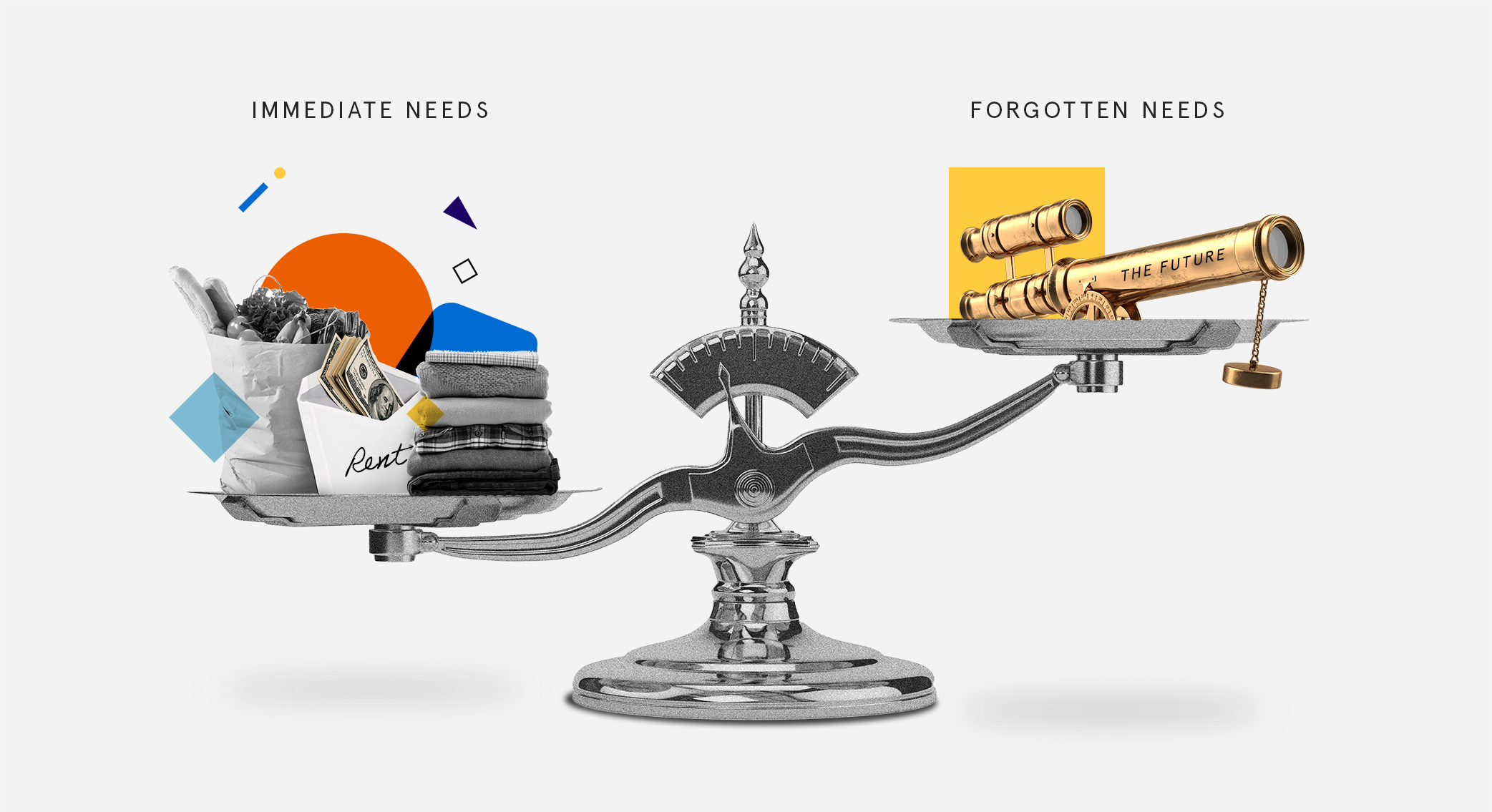

Immediate concerns for basic needs displace long term planning and consideration of consequences.

Immediate concerns for basic needs displace long term planning and consideration of consequences.

With multiple competing demands on scarce resources, there are constant trade-offs and decision makers view every decision as one where something must be sacrificed for something else, and they become less sensitive to future consequences.

With multiple competing demands on scarce resources, there are constant trade-offs and decision makers view every decision as one where something must be sacrificed for something else, and they become less sensitive to future consequences.

For example, with people’s reluctance to get vaccinated or wear masks in public, knowing that herd immunity can protect against life threatening sickness for the immune-compromised constituents of society.

Have you ever been so hungry that you walk into the first restaurant you see, only to discover later that there was a tastier, cheaper option half a block down the road? If only you had walked a little further, you could’ve eaten your favourite food instead of settling for something else, but you were famished — a prime example of cognitive tunnelling.

How Scarcity Mindset Plays Out in Real Life

In one BEworks project, the government was offering subsidized electricity end energy efficient home upgrades (e.g., insulation, weather stripping, LED light bulbs, etc.) to help those coping with limited financial resources, but eligible customers overlooked the opportunity for what was essentially free money received over the course of the future. Unfortunately, they did not apply.

Scarcity mindset affects even everyday decisions. Why? Under scarcity, people’s preferences switch to immediate pleasure regardless of future pain, leading them to focus on immediate gratification, or hedonism. The result is increased discretionary spending and debt, because of improper cost calculations and a disregard for future obligations.

In the extreme, payday loans keep food on the table, but less extreme examples can be spending on small pleasures and ignoring mounting debt.

Optimism bias leads people to rationalize that they will save more next month and reduce their debt, although research fails to support this claim.

People also tend to make inferior choices when deliberating with constrained resources. For example, people often have the capacity to pay back debt and show proactive behavior towards this, but instead of paying the full credit card balance off, they pay the minimum because they would rather have cash sitting in their account. Having cash available may be reassuring when resources seem scarce but paying higher interest rates later may not be the best financial planning.

For lenders, this means that assumptions regarding creditworthiness may be less true during times of perceived scarcity and leading to a re-evaluation in credit granting.

Applying Behavioral Economics to Help Consumers

A first line of defense that can help consumers experiencing scarcity mindset is to simplify their choices by reducing both the amount and complexity of information that is considered for a decision. This allows consumers to make better choices, despite being in a constrained state of mind.

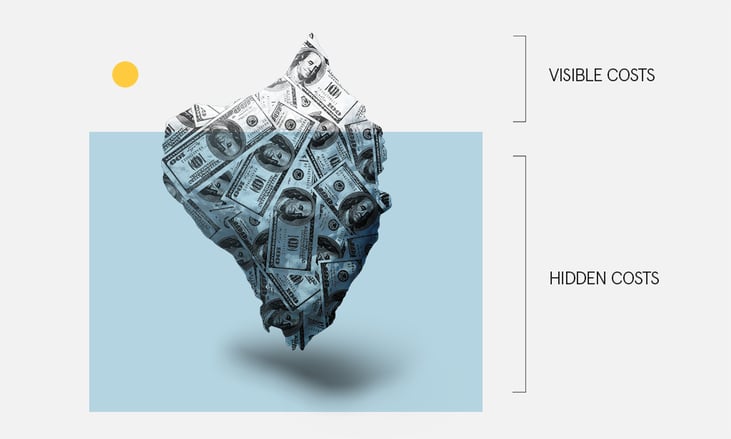

Another aspect of scarcity mindset is a heightened sensitivity to trade-offs and fear of hidden costs. Anticipated hassle costs can loom large enough that they stand in the way of consumers taking advantage of supports that exist to help them, such as professional financial advice or credit counselling.

To encourage consumers to connect with accessible support, it is crucial to address any over-estimates consumers may have about the time needed to get started. It may also be helpful to identify immediate tangible benefits that consumers will achieve within a short span of time of seeking support.

Working with a client in the energy industry, BEworks investigated why households suffer under the burden of high energy costs and did not take advantage of energy cost-savings programs. We found that interventions need to consider the scarcity mindset of consumers. We determined that consumers were not only uncertain about the time and effort required to participate in a program that can deliver energy cost-savings through free upgrades, but they failed to be enticed by typical incentives, such as highlighting the amount of money they could save over time. Since their temporal focus was immediate, future benefits were of little value.

We found that consumers were more moved to action when their attention was focused on the immediate, tangible benefits of the free upgrades that would help to make their day-to-day lives more comfortable (e.g., a quieter furnace, a warmer home, brighter LED lights, etc.). Even when the longer-term benefits of program participation, in the form of energy savings, took time to materialize.

In another example, encouraging credit card borrowers to pay off small purchases made improvement tangible and created a rewarding perception of progress.

A particularly topical example is a project where we assisted a client in encouraging more people to accept professional financial advice. We know that behavioral coaching can help people make better financial decisions, such as not panicking during market downturns, but we also know that far too many people do not seek and follow advice. With scarcity mindset, many of the same factors that we found in the energy project are also at work. People are excessively focused on today’s volatility and have difficulty engaging in thoughtful deliberation regarding advice and instead, panic and sell in volatile markets. Applying our knowledge of scarcity mindset, we were able to help people achieve better outcomes.

Changes in the market and the economy are inevitable. Consumers can avoid pitfalls by recognizing the psychological barriers and cognitive biases that can influence decisions, and by deploying tools grounded in behavioral science. This can include things like setting small tangible goals, reducing the number and the complexity of choices and engaging in wholistic, long-term thinking. Financial advisors can help their clients through behavioral coaching to help them recognize frequent failures to rational decision-making and the practices to overcome them.

References

1. Mullainathan, S., & Shafir, E. (2013). Scarcity: Why having too little means so much: Macmillan.